When three individuals form a partnership and agree to collaborate, they embark on a complex legal journey. This partnership entails a multifaceted framework that encompasses the rights, responsibilities, and financial considerations of each partner. This exploration delves into the intricacies of partnership formation, highlighting the legal processes, types of partnerships, and key elements of partnership agreements.

As the partnership evolves, the focus shifts to the rights and responsibilities of each partner. The concept of joint and several liability, as well as the fiduciary duties owed by partners to each other, are examined in detail. Furthermore, the discussion explores the various ways in which partnerships are managed, including voting rights and dispute resolution mechanisms.

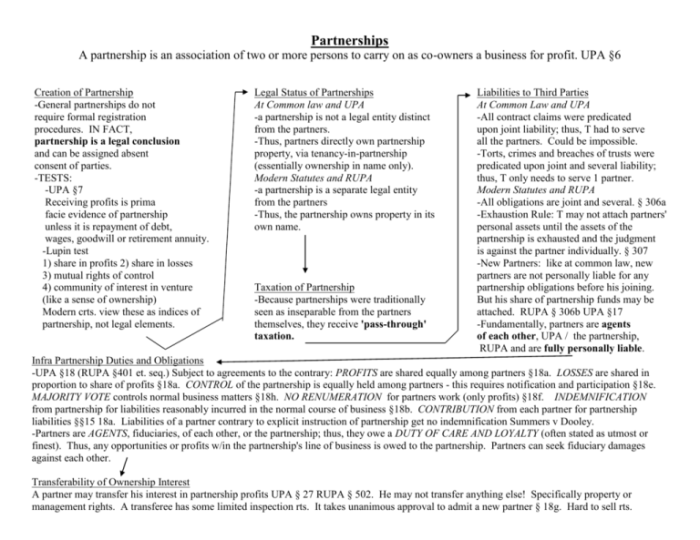

Partnership Formation

The legal process of forming a partnership involves several key steps. First, the individuals must agree to form a partnership. This agreement can be oral or written, but it is advisable to have a written agreement to avoid misunderstandings. The agreement should specify the terms of the partnership, including the name of the partnership, the purpose of the partnership, the duration of the partnership, and the rights and responsibilities of each partner.

There are different types of partnerships, each with its own characteristics. A general partnership is the most common type of partnership. In a general partnership, all partners are jointly and severally liable for the debts and obligations of the partnership.

A limited partnership is a type of partnership in which there are two types of partners: general partners and limited partners. General partners are jointly and severally liable for the debts and obligations of the partnership, while limited partners are only liable for the amount of their investment.

The key elements of a partnership agreement include the following: the name of the partnership, the purpose of the partnership, the duration of the partnership, the rights and responsibilities of each partner, the method of distributing profits and losses, and the process for resolving disputes.

Rights and Responsibilities of Partners

Each partner in a partnership has certain rights and responsibilities. The rights of partners include the right to participate in the management of the partnership, the right to share in the profits of the partnership, and the right to inspect the books and records of the partnership.

The responsibilities of partners include the duty to contribute to the capital of the partnership, the duty to act in the best interests of the partnership, and the duty to avoid conflicts of interest.

The concept of joint and several liability means that each partner is personally liable for the debts and obligations of the partnership. This means that if the partnership cannot pay its debts, the creditors can sue any one of the partners for the full amount of the debt.

Partners owe each other fiduciary duties. These duties include the duty of loyalty, the duty of care, and the duty of accounting. The duty of loyalty requires partners to act in the best interests of the partnership. The duty of care requires partners to exercise reasonable care in the management of the partnership.

The duty of accounting requires partners to keep accurate records of the partnership’s financial transactions.

Management and Decision-Making: Three Individuals Form A Partnership And Agree To

Partnerships can be managed in a variety of ways. In a general partnership, all partners have equal authority in the management of the partnership. In a limited partnership, the general partners have exclusive authority in the management of the partnership.

The voting rights of partners vary depending on the type of partnership. In a general partnership, each partner has one vote. In a limited partnership, the general partners have the exclusive right to vote.

The process for resolving disputes between partners is typically set forth in the partnership agreement. The agreement may provide for mediation, arbitration, or litigation.

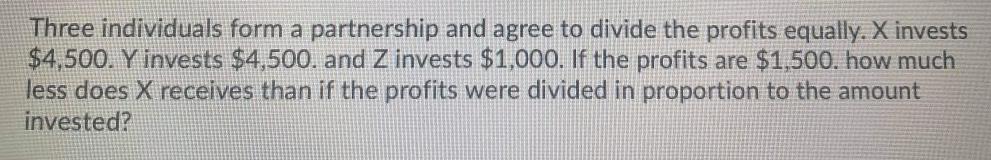

Financial Considerations

Profits and losses are shared among partners in accordance with the terms of the partnership agreement. The agreement may provide for equal sharing of profits and losses, or it may provide for a different distribution based on the partners’ capital contributions or other factors.

Partners can contribute capital to the partnership in a variety of ways. The most common methods of capital contributions are cash, property, and services.

The tax implications of partnership income depend on the type of partnership. General partnerships are not subject to income tax. Instead, the partners report their share of the partnership’s income on their individual tax returns.

Dissolution and Winding Up

A partnership can be dissolved for a variety of reasons, including the death of a partner, the withdrawal of a partner, or the bankruptcy of the partnership.

The process for winding up a partnership involves the following steps: liquidating the partnership’s assets, paying off the partnership’s debts, and distributing the remaining assets to the partners.

The distribution of assets and liabilities upon dissolution is typically set forth in the partnership agreement. The agreement may provide for equal distribution of assets and liabilities, or it may provide for a different distribution based on the partners’ capital contributions or other factors.

Frequently Asked Questions

What are the different types of partnerships?

There are three main types of partnerships: general partnerships, limited partnerships, and limited liability partnerships.

What are the key elements of a partnership agreement?

The key elements of a partnership agreement include the names of the partners, the purpose of the partnership, the capital contributions of each partner, the profit-sharing arrangement, and the dispute resolution process.

What are the rights and responsibilities of partners?

Partners have the right to share in the profits of the partnership and to participate in the management of the partnership. They also have the responsibility to contribute to the capital of the partnership and to share in the losses of the partnership.